Artificial Intelligence is no longer just a buzzword it’s a financial game-changer. If you’ve been wondering how to use AI for stock market analysis, you’re about to discover a modern approach that combines data-driven insights with smart decision-making. This article will show you why AI matters in trading, the benefits it brings, step-by-step guidance, expert strategies, and the top AI applications shaping stock investing in 2025.

Why How to Use AI for Stock Market Analysis Matters in 2025

The financial world is evolving at lightning speed. Traditional methods like reading charts or watching CNBC headlines aren’t enough anymore. In 2025, markets move based on millions of micro-signals—social media chatter, global news, sentiment trends, and algorithmic trading activity. AI can process these signals faster than any human, providing investors with real-time insights, predictive forecasts, and personalized recommendations.

For self-development and personal growth, learning to harness AI in stock analysis is like upgrading your financial mindset. It helps you make smarter, less emotional decisions, reduces guesswork, and aligns your financial goals with cutting-edge technology.

Top Benefits of How to Use AI for Stock Market Analysis

Real-Time Market Predictions

AI algorithms digest live data from thousands of sources—stock exchanges, global news, even Twitter feeds—to generate predictions that can help you anticipate market shifts before they happen.

Risk Management Made Simple

Instead of relying on gut instincts, AI uses predictive analytics to calculate risk exposure. For instance, it can flag when your portfolio is overexposed to volatile sectors, protecting you from unnecessary losses.

Emotion-Free Investing

Fear and greed ruin more portfolios than bad companies do. AI-powered trading bots operate without emotions, ensuring disciplined execution of strategies and consistency in decision-making.

Personalized Investment Insights

Modern AI platforms tailor advice based on your risk tolerance, investment goals, and trading style—helping you grow wealth on your own terms.

Step-by-Step Guide to How to Use AI for Stock Market Analysis

- Choose the Right AI Platform

Research tools like Trade Ideas, TrendSpider, or MetaStock. Look for platforms with proven accuracy, real-time alerts, and user-friendly dashboards. - Define Your Goals

Are you day trading, swing trading, or long-term investing? Setting clear goals allows AI models to provide the most relevant recommendations. - Feed the Data

Sync your brokerage account or import your watchlist. AI thrives on data, so the more input you provide (sectors, timeframes, stocks), the sharper the output. - Analyze AI-Generated Signals

Review buy/sell signals, heatmaps, and sentiment analysis. Compare AI predictions with your own research for confirmation. - Test with Paper Trading

Before risking real money, practice with AI-driven paper trading simulations to see how predictions perform. - Automate Where Possible

Set up AI alerts or even auto-trading features to save time and reduce emotional bias. - Track and Adjust

Regularly review performance and adjust parameters. AI improves when you refine inputs over time.

Pro Strategies to Maximize How to Use AI for Stock Market Analysis

- Don’t Rely on AI Alone: Use it as a guide, not gospel. Human intuition still matters.

- Avoid Data Overload: More isn’t always better. Stick to relevant signals.

- Combine AI With Fundamentals: Blend AI technical signals with company earnings, debt ratios, and market news for a holistic view.

- Stay Updated: AI models evolve. Always update software and explore new features for maximum efficiency.

- Guard Against Overfitting: Be cautious of AI models that “look perfect” on historical data but fail in real markets.

7 Trending Applications in 2025 for How to Use AI for Stock Market Analysis

AI-Powered Sentiment Analysis

Artificial intelligence now has the ability to scan financial blogs, global news, and even social media platforms like X (formerly Twitter) to detect overall market sentiment. By measuring shifts in tone—whether bullish optimism or bearish fear—AI tools can provide traders with real-time alerts that help anticipate sudden market swings.

Predictive Stock Screening

Machine learning models are redefining how investors screen stocks. Instead of waiting for mainstream analysts to highlight opportunities, AI can uncover undervalued or overhyped companies early. This gives investors a first-mover advantage and helps build stronger portfolios.

Automated Trading Bots

One of the fastest-growing applications of AI is in automated trading. These bots analyze market conditions and execute trades instantly based on AI-generated signals. This reduces the chance of missed opportunities and ensures that decisions are made without emotional interference.

Portfolio Optimization Tools

Gone are the days of manually rebalancing your portfolio. AI now uses advanced probability models to balance risk and reward, ensuring your investments align with your goals. These optimization tools continuously adjust allocations based on market changes, maximizing returns while minimizing risks.

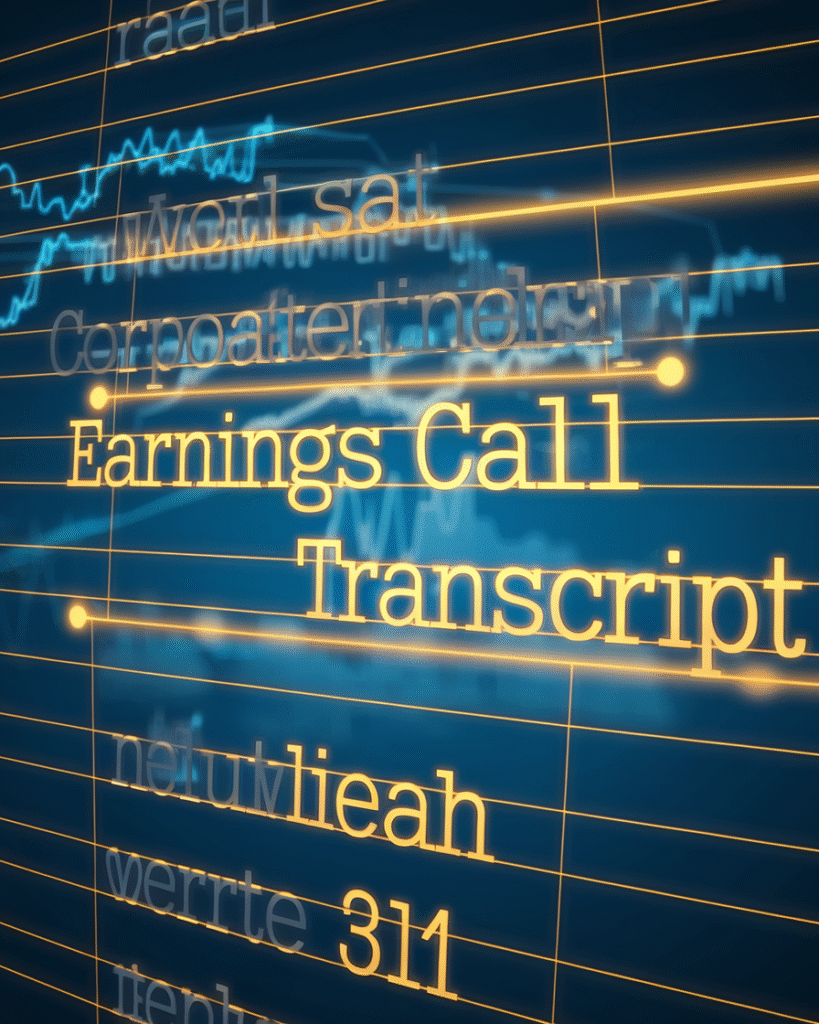

Natural Language Processing (NLP) for Earnings Calls

Earnings calls are often filled with subtle cues that traditional analysis might miss. AI-powered NLP systems can now interpret tone, sentiment, and keywords in real-time, offering predictive insights into how stock prices may react after a call.

Fraud and Market Manipulation Detection

Market manipulation tactics are becoming more sophisticated, but so are AI systems. These tools can detect suspicious trading activity, spot pump-and-dump schemes, or flag unusual volumes that may suggest insider trading—protecting investors from costly traps.

AI-Driven Macro Forecasting

AI isn’t just about single stock moves—it’s increasingly being used to forecast global economic shifts. From predicting interest rate hikes to monitoring commodity markets, AI provides a big-picture view that helps investors prepare for broader financial trends.

Conclusion – Bringing How to Use AI for Stock Market Analysis Into Your Life

In 2025, AI isn’t replacing human investors—it’s empowering them. By combining human intuition with AI’s speed and precision, you can build smarter strategies, avoid costly mistakes, and grow your wealth with confidence. The time to adopt AI for stock market analysis is now. The earlier you start, the stronger your financial edge will be.

FAQs About How to Use AI for Stock Market Analysis

Q1: Can beginners use AI for stock market analysis?

Yes. Many AI platforms are designed for beginners with intuitive dashboards, guided trading signals, and paper trading simulations.

Q2: Is AI trading better than human trading?

AI is faster and more consistent, but human insight still matters. The best approach is a hybrid strategy combining AI insights with personal judgment.

Q3: What risks come with using AI for investing?

Over-reliance on AI, bad data inputs, and overfitting models are common risks. Always cross-check AI predictions with fundamentals.

Q4: How much does AI stock analysis software cost?

Plans range from free basic tools to premium services costing $50–$200 monthly, depending on features.

Q5: Can AI predict stock prices accurately?

AI can’t guarantee accuracy, but it significantly improves the probability of better predictions compared to manual analysis.