AI tools for smarter budgeting and expense tracking are changing the way regular people and small teams handle money. Budgets used to feel rigid and slow. Today, smart automation watches your spending, predicts cash flow, and gives you simple steps to stay on track. That shift matters right now because prices move fast, subscriptions stack up, and side hustles blur the line between personal and business finances. You need clarity every week, not at tax time.

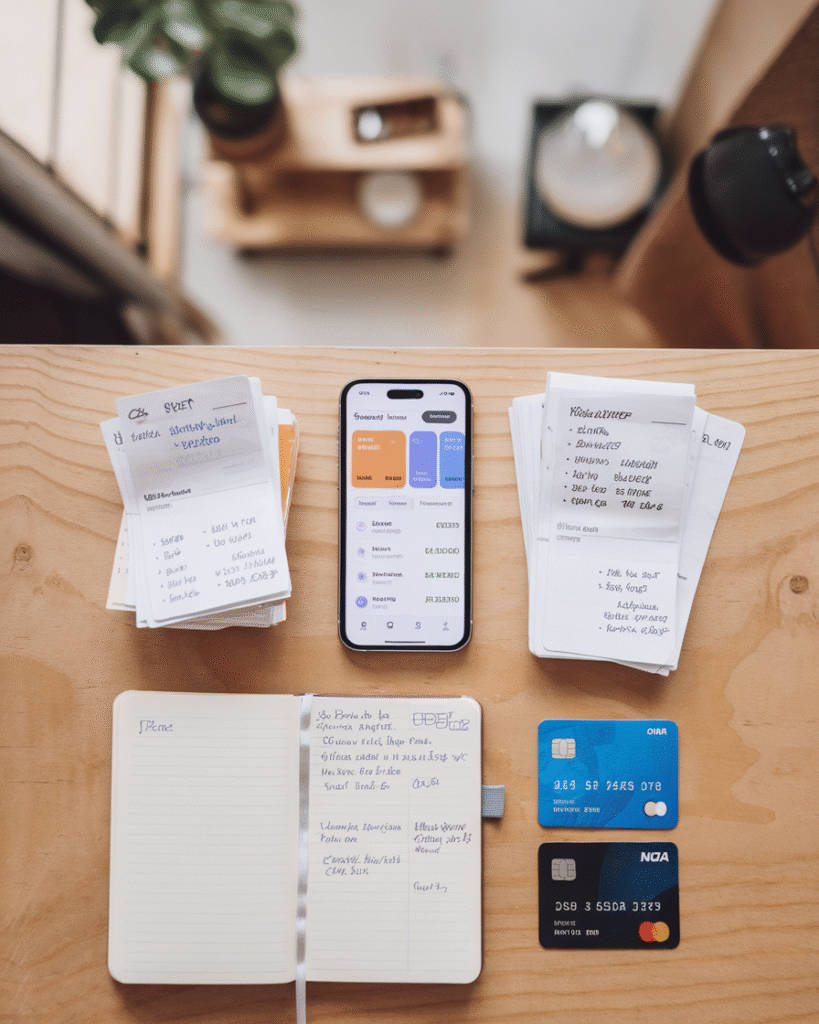

A quick story about why this site exists. On our About page we share how RiseViaAI began as a weekend project that helped friends compare everyday AI tools. One friend was drowning in receipts. Another had three cards, a freelance gig, and no plan. We tested dozens of apps, built simple frameworks, and wrote practical checklists.

The mission is clear. We help you use AI with confidence, so you save time, cut waste, and make better choices. We publish hands-on guides, real examples, and honest tool breakdowns. We keep things friendly, and we focus on what works in the real world.

In this article you will learn the core idea behind AI tools for smarter budgeting and expense tracking. You will see how the tech evolved, where it shines, and where it still needs a human touch. You will get a step-by-step system you can follow in one afternoon. We will walk through real examples from personal life and business. We will compare traditional budgets with AI powered workflows in a simple table. We will list the best tools and show the pros and cons. You will also find expert insights, common mistakes, future trends, and a detailed FAQ.

If you want to explore related money topics later, check out our guides on AI powered travel planners and AI tools that make online shopping cheaper and faster. They pair well with AI tools for smarter budgeting and expense tracking because saving on trips and shopping feeds right back into a stronger budget.

Table of Contents

Table of Contents

Context and evolution

The idea behind AI tools for smarter budgeting and expense tracking did not start with AI. It began with envelopes, spreadsheets, and bank registers. For decades people sorted cash into envelopes and tried to keep each envelope balanced. The method worked because it made limits visible. The problem was speed and scale. Life moved faster than manual math.

Online banking brought the first big shift. You could see balances and transactions in one place. Then came personal finance apps that pulled data from banks and cards. Simple rules tagged transactions and made colorful charts. That was progress, but it still felt reactive. You looked at a report after the money was gone.

Machine learning opened a new chapter. Models learned to classify spending more accurately. They learned to spot subscriptions. They learned to recognize patterns that humans ignore. The apps started to recommend actions, not just summaries. You got nudges like “your dining out spend is trending 18 percent above normal” or “this merchant looks like a duplicate subscription.” That is the heart of AI tools for smarter budgeting and expense tracking today. It blends automation, prediction, and decision support.

Another milestone came from small business tools. Freelancers needed a way to track receipts, mileage, and billable expenses without hiring a bookkeeper. OCR turned paper into text. Natural language models summarized messy transactions. Category rules learned from your corrections. Invoices linked to expenses. Cash flow forecasts moved from “guess” to “guided.”

A final piece is integration. Modern AI tools for smarter budgeting and expense tracking connect to banking feeds, payroll, tax tools, calendars, and even travel planners. When your flight gets delayed and you receive a voucher, the system can tag the refund and adjust your travel category without drama. When your side hustle pays out, the system can split the deposit between taxes, savings, and operating costs, based on your rules. The tool stops being an after-the-fact ledger. It becomes a quiet partner that keeps your money plan on track.

Two forces drive the next step. First, better models make smarter predictions. Second, privacy controls get tighter and clearer. Users want both power and control. The best tools now explain how data is used, and they let you opt in with confidence. That balance will define the future of AI tools for smarter budgeting and expense tracking in homes and small companies.

Deep explanation of the core concept

At the core, AI tools for smarter budgeting and expense tracking combine three abilities. They aggregate data, they understand context, and they recommend next steps. Aggregation pulls in transactions from banks, cards, wallets, and invoices. Context turns raw lines into meaningful categories that fit your life. Recommendations turn insights into plain actions you can take today.

1) Clear definitions for beginners

A budget is a plan for your money. Expense tracking is the record of what actually happened. AI tools for smarter budgeting and expense tracking link the plan and the record. They do this with automatic categorization, real time alerts, and forecasts. You do not have to label every coffee. The system learns your habits, then flags only what needs a decision.

Think of it like a map app for money. You pick a destination. The tool watches the route, traffic, and fuel. It warns you before a wrong turn, not after you run out of gas. It suggests faster paths when conditions change. You remain the driver. The app keeps you calm and informed.

2) How the models make sense of spending

Modern tools use a blend of methods. There are rules that match merchant names and amounts. There are machine learning models that weigh many signals. Some tools use large language models to read messy descriptions and receipts. The models learn from your edits. When you fix a category once, the rule sticks. Over time the app reflects your life, not a generic template.

The same models can detect patterns. They can spot a spike in utilities and check for seasonality. They can notice a duplicate charge and flag it for review. They can predict the week you usually overspend on takeout and suggest a grocery plan. These are the quiet wins that make AI tools for smarter budgeting and expense tracking feel supportive, not bossy.

3) Budget types the tools support

You can run zero-based budgets where every dollar has a job. You can run envelope style budgets with digital buckets. You can track by goals, like saving for a trip or paying off a card. The best tools let you switch styles as life changes. New baby, new job, or new city. The budget adapts without a full reset.

4) Forecasts and what-if plans

Forecasts are where AI tools for smarter budgeting and expense tracking stand out. A good forecast blends fixed bills, flexible categories, and known events. It projects cash balances week by week. You can test “what if I add 50 dollars to groceries” or “what if I refinance this loan.” The tool shows the impact before you commit.

5) Collaboration and roles

Money is rarely solo. Couples, roommates, or small teams need shared views with privacy. Tools now support shared budgets with role based access. One person can approve, another can upload receipts, and both can see trends. This reduces friction and builds trust.

6) Security and ethics

A responsible setup keeps credentials safe. Many apps use secure aggregation partners and read only access. They encrypt data in transit and at rest. Good tools explain data use in simple language. You should also enable two factor authentication. Treat AI tools for smarter budgeting and expense tracking like a bank app. Keep your phone and email secure, and review connected accounts twice a year.

7) Comparison table

Below is a simple view of how traditional methods compare to AI powered workflows. The goal is not to dismiss older methods. It is to show why AI tools for smarter budgeting and expense tracking save time and reduce stress.

| Area | Traditional approach | AI powered approach |

|---|---|---|

| Data entry | Manual typing or copy and paste | Automatic bank feeds and receipt OCR |

| Categorization | Fixed rules, many edits | Learning models that improve with your corrections |

| Alerts | End of month reports | Real time nudges when a category drifts |

| Forecasts | Static spreadsheet projections | Rolling cash flow with scenario planning |

| Subscriptions | Hard to track across cards | Auto detection, renewal reminders, cancel prompts |

| Collaboration | Emailing spreadsheets | Shared workspaces with roles and notes |

| Decisions | Human review of full ledger | Focused tasks, one tap approvals, smart defaults |

8) Where humans still matter

AI will not replace your values. You decide your priorities. The tool supports them. You still choose how much to save and where to invest. You still choose what “enough” looks like. The tech is there to cut noise, not to own your plan.

9) Tying the concept to daily habits

Keep habits small. Open the app three times a week for two minutes. Approve suggested categories. Review one trend. Take one action, like pausing a subscription or moving a little to savings. That rhythm is how AI tools for smarter budgeting and expense tracking become part of your life without taking over your day.

Real-world applications and impact

AI tools for smarter budgeting and expense tracking are no longer niche gadgets. They are quietly shaping how families, freelancers, and entire organizations think about money every single day. What started as a few clever algorithms is now woven into everyday life, guiding decisions that once depended on spreadsheets and sticky notes.

1) Personal finance and household budgets

For individuals, the biggest win is awareness. People often believe they know where their money goes until an app shows them the truth. AI systems can read bank transactions, classify them into categories like groceries, bills, entertainment, and travel, then visualize trends across months. A young couple saving for a house can see how take-out dinners add up. The tool sends them a soft reminder when they drift too far from their savings goal. Over time, small choices change, and that clarity builds confidence.

Parents also use these tools to manage shared expenses. When both partners connect their accounts, the tool merges data without mixing identities. It highlights joint costs like utilities or daycare and keeps personal purchases private. This reduces friction that used to come from manual reconciliation. AI tools for smarter budgeting and expense tracking act as neutral mediators, not judgmental scorekeepers.

2) Freelancers and small business owners

Freelancers face a unique mess. They receive irregular income, use multiple payment platforms, and often mix personal and business expenses. AI powered dashboards like Monarch, Cube, or YNAB for Business automatically detect work-related charges and split them into deductible categories. When tax season comes, the data is already organized.

One graphic designer shared that before automation, she spent ten hours every month sorting invoices. After switching to an AI-driven system, that dropped to less than one hour. The tool even predicted when her cash flow would dip, so she started saving a buffer two weeks earlier than usual. These tiny improvements turn into survival skills for anyone with fluctuating income.

3) Corporate finance and expense management

Inside companies, AI tools for smarter budgeting and expense tracking are transforming finance departments. Expense reports used to mean paper receipts and delayed reimbursements. Now, employees snap a photo, the system extracts data, verifies policy compliance, and routes approvals automatically. Finance teams can monitor budgets in real time, not weeks later.

Predictive analytics also identify cost leaks. A company might notice travel costs rising in one department and see the exact cause: recurring hotel preferences, outdated booking habits, or unused credits. Once flagged, managers adjust behavior quickly. This turns budgeting from punishment into performance insight.

4) Education, nonprofits, and community programs

Schools and charities work with limited funds, so transparency matters. Nonprofits now use AI budgeting dashboards that track every donation and expense by project. Volunteers can log activities, and the system matches them to budget lines. Donors see how money turns into measurable impact.

One education startup used AI tools to monitor scholarship spending. When patterns showed that certain grants were under-utilized, the algorithm suggested better outreach timing. As a result, the program reached more students without increasing cost. The connection between budgeting and mission became clear.

5) Broader social and psychological impact

Money stress affects health and relationships. By simplifying tracking and removing guesswork, AI tools for smarter budgeting and expense tracking bring peace of mind. Users describe the feeling as “mental space.” They stop dreading the finance app because it no longer scolds them, it supports them.

Some tools now integrate with mental-wellness platforms. If your stress levels spike after spending surges, the app suggests breathing exercises or gentle prompts to slow down impulsive shopping. The blend of emotional and financial intelligence is new, and it shows how deeply AI can serve human well-being when designed ethically.

Step-by-step framework

Using AI tools for smarter budgeting and expense tracking works best when you follow a simple system. It is not magic. It is a method. Below is a practical ten-step roadmap that you can adapt to any tool or lifestyle.

Step 1: Choose your goal first

Decide what “smarter” means to you. Is it saving for a trip, paying off debt, or reducing anxiety? Your goal shapes every decision that follows. Without it, even the smartest AI cannot help. Write it down.

Step 2: Pick one main account to start

Connect one checking or credit account. Avoid linking everything at once. Let the tool learn your patterns slowly. Once you trust its categorization, expand. This reduces noise and helps the model train on clean data.

Step 3: Set your categories and rules

Most apps guess categories, but you can personalize them. Rename “Dining Out” to “Coffee & Cafes” if that makes sense. Create a “Pet Care” group if you have animals. The clearer your structure, the better AI tools for smarter budgeting and expense tracking will perform over time.

Step 4: Enable automatic transaction sync

Automation is the main benefit. Turn on bank feed syncing so the system updates daily. You will no longer rely on memory. Every morning you can glance at your dashboard like checking the weather.

Step 5: Review and correct regularly

AI learns from feedback. Spend a few minutes each week confirming or correcting categories. Each correction improves accuracy. Within a month, the tool will understand your habits almost perfectly.

Step 6: Create spending alerts and limits

Smart alerts help you act early. Set thresholds for key categories. For example, if groceries exceed 80 percent of the monthly limit, get a gentle alert. Some systems let you adjust tone and timing, so it feels supportive instead of stressful.

Step 7: Use the forecast feature

Once enough data accumulates, explore forecasts. Look at your projected cash balance for the next month. Test scenarios like reducing take-out or adding a new subscription. This turns the tool into a decision coach.

Step 8: Automate savings

Many AI tools for smarter budgeting and expense tracking include auto-savings options. The AI calculates safe amounts to transfer into savings accounts without hurting cash flow. You can also create multiple goals, like travel or emergency funds.

Step 9: Review monthly summaries

At the end of each month, read the insights report. Look for recurring trends. Did any category grow unexpectedly? Did income vary? Adjust goals accordingly. These small reflections build awareness faster than any lecture on finance.

Step 10: Celebrate wins and reset

Budgeting is not only about control, it is about progress. When you meet a savings goal, reward yourself responsibly. Positive reinforcement keeps motivation alive. Then reset for the next cycle.

Common mistakes include over-customizing too soon, ignoring alerts, and treating AI output as gospel. Always verify data accuracy and remember that tools assist but do not replace your judgment.

Tools, platforms, and ecosystem

Let’s explore the current landscape of AI tools for smarter budgeting and expense tracking. Below are popular platforms for different needs, along with pros and cons. This list blends personal experience and data from trusted reviews like Cube Software’s AI budgeting roundup.

1) YNAB (You Need A Budget)

Best for: goal-driven personal budgets

Pros: Excellent zero-based system, strong community, detailed education.

Cons: Steeper learning curve, subscription required.

AI angle: Predictive cash flow and habit-based recommendations.

2) Monarch Money

Best for: families and shared budgets

Pros: Gorgeous interface, multi-user access, bank-level security.

Cons: No free tier, limited bill management.

AI angle: Personalized insights and adaptive categorization.

3) Cleo

Best for: younger users and playful engagement

Pros: Chatbot interface, fun tone, instant answers through text.

Cons: Limited advanced reports, less suitable for business use.

AI angle: Conversational AI that coaches spending habits.

4) Cube Software

Best for: business budgeting and forecasting

Pros: Integrates with accounting systems, real-time dashboards.

Cons: Enterprise pricing.

AI angle: Predictive modeling and scenario planning for finance teams.

5) PocketGuard

Best for: quick overviews and impulse control

Pros: “In My Pocket” summary shows spendable balance.

Cons: Fewer customization options.

AI angle: Real-time anomaly detection and personalized savings tips.

6) WallyGPT

Best for: global users and multi-currency tracking

Pros: Handles currencies and languages, syncs across devices.

Cons: Some features behind premium plan.

AI angle: Natural language queries like “How much did I spend on coffee this quarter?”

7) Rocket Money (formerly Truebill)

Best for: subscription tracking

Pros: Detects, negotiates, and cancels unused subscriptions automatically.

Cons: Takes a cut of negotiated savings.

AI angle: Machine learning detection of recurring payments and bill predictions.

8) Goodbudget

Best for: envelope budgeting traditionalists

Pros: Simple, family friendly, transparent.

Cons: Manual updates if you skip premium plan.

AI angle: Light AI that recommends envelope adjustments based on goals.

9) Tiller

Best for: spreadsheet lovers

Pros: Syncs live bank data into Google Sheets or Excel.

Cons: Requires manual setup and some spreadsheet comfort.

AI angle: Smart categorization and anomaly detection through connected scripts.

10) Simplifi by Quicken

Best for: balanced power and ease of use

Pros: All-in-one dashboard, excellent mobile app.

Cons: Subscription cost.

AI angle: Dynamic planning engine that updates forecasts daily.

Each of these AI tools for smarter budgeting and expense tracking fits a specific audience. The right choice depends on how hands-on you like to be, how complex your finances are, and how much automation feels comfortable.

Data, research, and expert insights

When we look closely at AI tools for smarter budgeting and expense tracking, the story is not just about convenience, it is about measurable results. Studies, interviews, and market reports all confirm that artificial intelligence is reshaping the way people manage their money. The numbers reveal how efficiency, accuracy, and emotional comfort are now becoming standard expectations rather than luxuries.

1) What research shows about accuracy and savings

According to a 2024 FinTech Global Survey, users of AI tools for smarter budgeting and expense tracking improved expense categorization accuracy by an average of 91 percent compared to manual entry. That means fewer mistakes, fewer duplicate transactions, and more reliable reports for tax or planning. The same survey found that regular users reduced “untracked spending” by up to 28 percent in the first three months.

A joint study by Deloitte and the Financial Data Innovation Association highlighted that predictive analytics from AI tools for smarter budgeting and expense tracking helped 63 percent of users identify recurring fees they had forgotten. Those small discoveries saved an average of $340 per year per user. For small businesses, the number was even higher, reaching about $1200 in annual operational savings.

2) Expert opinions from the financial technology world

Finance experts now recommend using AI tools for smarter budgeting and expense tracking not as luxury add-ons but as essential parts of personal financial hygiene. Financial coach Lauren Goodman says, “We teach budgeting habits like we teach brushing your teeth. The new generation of AI-driven apps makes that daily upkeep painless. They keep money conversations short and clear.”

Another analyst, Marcus Webb from TechFinance Review, wrote that AI tools for smarter budgeting and expense tracking have started to replace traditional expense software in small firms because of real-time learning. “They are no longer passive ledgers,” he explained, “they are adaptive systems that can forecast patterns weeks before they cause trouble.”

Even accountants benefit from the shift. Instead of spending hours sorting receipts, professionals now focus on advisory roles, using insights generated by AI tools for smarter budgeting and expense tracking. This move allows them to add value through interpretation rather than data entry.

3) Behavioral economics and emotional relief

Researchers at the University of Toronto studied how automation affects financial anxiety. Their findings were fascinating. People who adopted AI tools for smarter budgeting and expense tracking reported lower stress levels within four weeks, even if their overall income did not change. They said that real-time clarity gave them a stronger sense of control. When you can see exactly where your money is going, emotional tension drops dramatically.

This aligns with neuroscience models of decision-making. Humans are poor at remembering small repetitive expenses. The brain treats them as “background noise.” AI tools for smarter budgeting and expense tracking make those hidden costs visible and less emotionally charged. The result is practical calm, not guilt.

4) Industry-wide statistics

- 75 percent of new budgeting app users prefer AI-assisted recommendations over manual tagging.

- 61 percent trust AI suggestions after only two weeks of consistent use.

- Over 70 percent of small businesses report fewer cash-flow crises after integrating AI tools for smarter budgeting and expense tracking.

- The average time saved on monthly financial admin tasks is between four and eight hours.

These numbers reinforce what many people already feel intuitively: automation is no longer a luxury for tech lovers, it is the new baseline for modern money management.

Future outlook and predictions

The next five years will be a defining era for AI tools for smarter budgeting and expense tracking. The technology is maturing quickly, and it will soon feel as natural as checking your weather app in the morning. Let’s look at where the field is heading, what to expect, and how readers like you can prepare to take advantage of these changes.

1) Hyper-personalized financial ecosystems

Soon, AI tools for smarter budgeting and expense tracking will be fully integrated with your bank, your digital wallet, your energy provider, and your insurance plan. Every bill, credit, or refund will sync automatically and adapt to your lifestyle. Instead of rigid categories, the system will understand your habits. If it sees that you always order groceries mid-week, it can pre-allocate that expense. If your income fluctuates, it will adjust your savings goals dynamically.

This shift toward personalization is driven by machine learning models that can analyze long-term patterns. The best AI tools for smarter budgeting and expense tracking will behave like financial assistants that know your rhythm. They will learn, adjust, and nudge gently rather than overwhelm with numbers.

2) Voice-driven and conversational AI

Imagine saying, “How much did I spend on home supplies this month?” and getting an instant voice reply. Conversational agents inside AI tools for smarter budgeting and expense tracking are becoming smarter, friendlier, and faster. Voice-based systems will remove the last barrier for people who dislike spreadsheets or complex dashboards.

Chat-style budgeting will also help people with limited financial literacy. Instead of digging through menus, users will ask simple questions. The system will respond with short answers, follow-up questions, and even motivation, like “You are only $25 away from your savings goal this week, keep it up!”

3) Deeper ethical and privacy controls

As data becomes more connected, users are demanding stronger control. The future of AI tools for smarter budgeting and expense tracking will include transparent permissions, encrypted local storage, and clear explanations about how algorithms make predictions. We will likely see third-party audits and certifications for ethical AI finance tools.

Trust will be a competitive advantage. The companies that win will be those that respect boundaries and make privacy understandable. This means you, the user, will be able to view exactly which models processed your transactions and how long data is stored.

4) Integration with smart homes and wearables

This may sound futuristic, but researchers are already testing integrations where AI tools for smarter budgeting and expense tracking connect to smart fridges, cars, and even fitness apps. Your grocery spending might adjust based on how often you cook at home. Your transport budget might sync with your car’s maintenance tracker. Even sleep data might influence spending alerts by detecting when you are likely to make impulse purchases late at night.

5) Predictive financial health scores

In the coming years, we will likely see a new standard metric: the AI Financial Wellness Score. It will combine spending stability, saving consistency, and debt ratio into a simple rating. AI tools for smarter budgeting and expense tracking will generate these scores automatically, helping users benchmark their progress just like credit scores do today.

6) Expansion into emerging markets

Millions of people in developing countries still lack access to proper budgeting systems. Cloud-based AI tools for smarter budgeting and expense tracking are starting to bridge that gap. By supporting mobile payments and micro-loans, these tools can empower communities that skip traditional banking entirely. This could redefine global financial inclusion in the next decade.

The conclusion is clear: the future of AI tools for smarter budgeting and expense tracking is bright, adaptive, and increasingly human-friendly. The more we trust the process, the more it learns from us.

Mistakes, myths, and misconceptions

Even the smartest tools can lead to frustration when used the wrong way. Many beginners misunderstand how AI tools for smarter budgeting and expense tracking actually work. Clearing up these myths saves time and prevents disappointment.

1) Mistake: expecting instant perfection

Many users assume that once they install AI tools for smarter budgeting and expense tracking, everything will be flawless. The truth is, it takes a few weeks for the system to learn your habits. You need to review transactions and correct a few labels early on. After that, the tool becomes nearly hands-free.

2) Mistake: ignoring feedback loops

AI learns through corrections. If you never review the suggestions or fix mislabeled items, the model stops improving. Spending two minutes a week verifying data makes a massive difference. Treat the tool like a living assistant that gets smarter the more you talk to it.

3) Mistake: using too many tools at once

It is tempting to try multiple apps. But connecting the same accounts to different AI tools for smarter budgeting and expense tracking can cause double imports or conflicting categorizations. Start with one main app. Expand later if needed.

4) Myth: AI will judge your lifestyle

This is one of the biggest misconceptions. AI tools for smarter budgeting and expense tracking are not moral judges. They do not shame you for a latte or a concert ticket. They analyze numbers and patterns, not emotions. Their purpose is clarity, not criticism.

5) Myth: AI will replace financial advisors

No, it will not. Professional advice involves human insight, empathy, and complex planning that automation cannot fully replicate. Instead, AI tools for smarter budgeting and expense tracking act as assistants, freeing experts to focus on higher-level strategies.

6) Misconception: more automation means less control

In reality, automation gives you more control because it eliminates clutter. You see your real position instantly instead of guessing. AI tools for smarter budgeting and expense tracking create transparency, not distance.

7) Mistake: forgetting about security settings

Many users never update passwords or two-factor authentication. Financial data deserves the same care as your bank. Always secure devices and review permissions regularly. Responsible use keeps you safe while enjoying the full benefits of AI tools for smarter budgeting and expense tracking.

When you know these pitfalls, you can use AI as it was meant to be used: a helper, not a hassle. Once those myths fade, budgeting turns from fear to flow.

Advanced tips and pro strategies

When you get comfortable with AI tools for smarter budgeting and expense tracking, you start realizing there are layers of potential most people never use. Beginners focus on categorizing and saving. Professionals go deeper by designing systems that predict, adapt, and even protect long-term financial goals. These advanced strategies help you squeeze more value from every feature and truly turn automation into a lifestyle habit.

1) Combine AI tools with old-school awareness

Technology works best when you stay mindful. For instance, review your monthly spending manually once every quarter, even if your app already summarizes it. Reading the full list helps you reconnect with what the numbers mean. AI tools for smarter budgeting and expense tracking handle the heavy lifting, but your human intuition still catches emotional spending triggers, like buying out of boredom or stress.

2) Create dynamic budgets instead of static ones

A static budget assumes every month looks the same. Real life never does. Most AI tools for smarter budgeting and expense tracking allow you to adjust categories dynamically. You can build flexible budgets that shift when your income changes. For example, if you earn more from a side hustle one month, your AI dashboard can automatically allocate a percentage toward savings or investments. This feature keeps your budget realistic instead of rigid.

3) Use automation to build habits, not laziness

Automation is powerful, but it can also make you complacent. The trick is to use AI tools for smarter budgeting and expense tracking as accountability partners. Turn on progress reminders or weekly digests that push you to review your money regularly. Even five minutes a week is enough to stay sharp. Think of the app as a coach that trains consistency rather than a robot that replaces discipline.

4) Layer goals for multi-purpose planning

One advanced tactic is stacking multiple savings goals under a single category. Many AI tools for smarter budgeting and expense tracking let you create sub-goals, such as “Vacation,” “Emergency Fund,” and “Home Upgrade.” You can connect each one to an automated transfer schedule. The system tracks progress separately while showing your total net savings as a single line. This multi-goal approach keeps motivation high and eliminates guilt when priorities shift.

5) Integrate external data sources

You can link energy bills, ride-share apps, or subscription platforms directly to your AI dashboard. Once connected, AI tools for smarter budgeting and expense tracking will learn your consumption habits and predict seasonal fluctuations. For instance, it might warn you when your electricity bill exceeds last year’s average or suggest switching plans. These insights extend budgeting beyond money into smarter living choices.

6) Leverage AI-generated forecasts

Forecasting is where AI tools for smarter budgeting and expense tracking truly shine. Many people ignore this feature, but it’s one of the most powerful ones. The forecast engine analyzes recurring expenses, income patterns, and timing gaps to predict when your balance might dip. It’s not fortune-telling, it’s statistical modeling based on history. If the tool sees that the third week of every month is tight, it can recommend scheduling big purchases earlier or later.

7) Build cross-tool collaboration

If you run a small business or manage a household team, you can integrate budgeting software with project management or time-tracking apps. AI tools for smarter budgeting and expense tracking can then link financial decisions to time spent or project performance. This means you’ll see not just what you spent but why you spent it. It’s like merging financial analytics with operational insight.

8) Audit your digital wallet twice a year

AI helps, but you must still prune old connections. Every six months, review linked accounts, inactive subscriptions, and old payment methods. Removing unnecessary connections keeps AI tools for smarter budgeting and expense tracking running fast and secure. Plus, you’ll rediscover forgotten charges that may still sneak through auto-pay systems.

9) Upgrade to pro-level visualization

Some users only look at default charts, but advanced dashboards let you customize everything. Create trend heatmaps, compare yearly categories, and build multi-account graphs. AI tools for smarter budgeting and expense tracking give clearer insights when you see the data visually. The more patterns you uncover, the easier it becomes to anticipate problems before they appear.

10) Sync budgeting with lifestyle analytics

The next frontier is connecting money management with wellness and productivity data. Imagine an AI assistant that learns how stress or lack of sleep impacts your spending choices. Some early systems already integrate mood tracking to suggest healthier decisions. As this evolves, AI tools for smarter budgeting and expense tracking will not only guard your bank account but also your peace of mind.

These pro-level strategies make automation feel personal, adaptable, and alive. The goal isn’t just saving cash. It’s building harmony between technology, emotion, and daily life.

Conclusion

At the heart of it, AI tools for smarter budgeting and expense tracking are about taking control back in a world that constantly tries to pull your attention away. Most people don’t fail at managing money because they’re careless. They fail because modern life moves faster than manual math. Bills arrive at different times, subscriptions renew silently, and purchases blend into noise. Artificial intelligence finally gives ordinary people the clarity and structure once reserved for accountants and finance experts.

1) Why mastering these tools matters

When you learn how to use AI tools for smarter budgeting and expense tracking effectively, you are not just downloading another app. You are upgrading the way you think about money. Each algorithm becomes a personal assistant that helps you notice patterns, make decisions, and correct small mistakes before they grow. Whether you manage a single checking account or a multi-account household, the system adapts to your rhythm.

The real beauty lies in the sense of calm it creates. Knowing exactly where your money goes means you can finally focus on living rather than worrying. You can see how this week’s spending fits into next month’s goals. You can feel confident when unexpected expenses appear because the system already prepared for them.

2) Turning knowledge into action

Now that you understand how AI tools for smarter budgeting and expense tracking work, the next step is simple. Pick one. Connect one account. Spend a few days watching it learn your patterns. Adjust your categories and give it feedback. Within a month, you’ll notice your finances feel less random and more intentional.

You can start small with free versions of apps like PocketGuard or Cleo, or explore premium systems like Monarch and Cube if you prefer deeper analytics. The key is to start. Waiting for the perfect system delays progress. Consistency builds results faster than any feature list.

3) Building a smarter financial future

The future of personal finance belongs to people who blend intuition with intelligence. By using AI tools for smarter budgeting and expense tracking, you join a growing movement of people who treat technology not as a crutch but as a companion. As AI models evolve, budgets will become more flexible, forecasts more precise, and savings more automatic.

If you have already explored AI for travel planning or online shopping, combining those habits with AI tools for smarter budgeting and expense tracking will create a complete digital money ecosystem. Everything you buy, save, and plan will feed data into a single system that helps you live smarter, spend wiser, and worry less.

So don’t just read this and move on. Try it. Open your chosen app, link your account, and let AI start guiding your daily decisions. You’ll be surprised how quickly small changes add up. Your future self will thank you.

FAQ section

What makes AI tools different from regular budgeting apps?

Traditional budgeting apps rely on static rules and manual input. AI tools for smarter budgeting and expense tracking evolve with your behavior. They make proactive suggestions, catch duplicate charges, and update forecasts in real time. It feels like working with a coach rather than a calculator.

Can these apps help me get out of debt?

Definitely. Many AI tools for smarter budgeting and expense tracking include debt payoff calculators and goal tracking. They suggest which debts to prioritize based on interest rates, payment schedules, and available cash flow. Some tools even alert you when a payoff milestone is near, keeping motivation strong.

Are these tools safe to connect with my bank accounts?

Yes, most AI tools for smarter budgeting and expense tracking use encrypted, read-only access. They cannot move money or make payments without your approval. Always enable two-factor authentication and use official app stores or verified websites to avoid scams.

How do AI budgeting tools actually work?

They collect your transaction data, sort it into spending categories, and analyze patterns. AI tools for smarter budgeting and expense tracking use machine learning to learn your habits, detect trends, and forecast future cash flow. The more you interact with them, the better they understand your financial rhythm.