Are you tired of missing out on the best property investments while others seem to snap them up instantly? Learning how to use AI to find profitable real estate deals could be the edge you need in 2025. With artificial intelligence evolving faster than ever, investors now have access to smarter, data-driven insights that can uncover hidden opportunities, reduce risks, and maximize profits. This guide breaks down everything you need to know to leverage AI for real estate success.

Why How to Use AI to Find Profitable Real Estate Deals Matters in 2025

The real estate market in 2025 is more competitive and dynamic than ever. Traditional methods of analyzing deals—manual research, agent referrals, or word-of-mouth—simply can’t keep up with the speed of modern investment opportunities. AI changes that. It processes vast amounts of property data, rental trends, demographic shifts, and even predictive analytics in seconds, helping investors spot undervalued properties before competitors.

Beyond just profits, AI empowers personal growth by teaching investors how to make data-driven decisions, reduce emotional bias, and think strategically about long-term wealth building. In short, AI isn’t just reshaping real estate—it’s reshaping how you grow financially and personally.

Top Benefits of How to Use AI to Find Profitable Real Estate Deals

Smarter Property Analysis

AI platforms can instantly evaluate a property’s price against market comparables, rental income potential, and renovation ROI. Instead of hours of spreadsheets, you get clear insights in seconds.

Predictive Market Trends

Machine learning models analyze historical data and economic patterns to forecast emerging neighborhoods. Investors can move into growth areas before they become hot.

Automated Deal Sourcing

AI scrapes listings, auctions, off-market deals, and foreclosure databases, bringing the best opportunities directly to your inbox.

Risk Reduction

AI tools detect red flags like poor neighborhood growth, hidden maintenance costs, or unstable rental markets—helping you avoid costly mistakes.

Step-by-Step Guide to How to Use AI to Find Profitable Real Estate Deals

- Define Your Investment Goals

Decide if you’re looking for flips, rental income, or long-term appreciation. AI models can then tailor results to your strategy. - Choose the Right AI Tool

Platforms like Mashvisor, DealMachine, or PropStream use AI to analyze profitability. Pick one that aligns with your needs. - Feed in Your Criteria

Enter location, budget, property type, and desired ROI. AI algorithms filter thousands of listings instantly. - Review Predictive Insights

Study the AI-generated reports on appreciation trends, rental demand, and neighborhood growth. - Run Scenario Simulations

AI lets you test different strategies—like holding vs. flipping—to see potential outcomes. - Perform Due Diligence

Use AI to cross-check with inspection reports, crime data, and local regulations. - Make Data-Backed Offers

Armed with AI analysis, confidently submit offers that maximize profitability.

Pro Strategies to Maximize How to Use AI to Find Profitable Real Estate Deals

- Combine AI with Human Expertise: Use AI for data insights but still consult local agents for neighborhood knowledge.

- Don’t Ignore Off-Market Deals: Many AI tools specialize in uncovering hidden gems not listed publicly.

- Beware of Over-Reliance: AI predicts based on data, but unexpected market shifts can still happen.

- Leverage Multiple Tools: Compare results across platforms for higher accuracy.

- Update Constantly: AI improves with new data—stay updated with the latest software features.

7 Trending Applications in 2025 for How to Use AI to Find Profitable Real Estate Deals

AI-Powered Neighborhood Scoring

In 2025, investors no longer have to rely on intuition alone to spot up-and-coming neighborhoods. AI now ranks neighborhoods by analyzing schools, infrastructure projects, job market growth, and even lifestyle trends. This helps investors buy properties before demand and prices skyrocket, giving them a strategic edge over competitors.

Automated Rent Estimation Models

Setting the right rental price is key to profitability, and AI makes it easier than ever. Advanced rent estimation models factor in local wages, housing demand, and competitor listings to provide accurate rental projections. This ensures your property remains attractive to tenants while maximizing returns from day one.

AI-Driven Renovation ROI Calculators

Not all upgrades are created equal. With AI-driven renovation ROI calculators, investors can predict which property improvements—like kitchen remodels, energy-efficient systems, or smart home upgrades—will deliver the best returns. This prevents wasted money on renovations that don’t add significant value.

Real-Time Deal Alerts

Instead of spending hours scrolling through listings, investors can now rely on AI to deliver real-time alerts when profitable deals hit the market. These alerts are personalized to your investment goals, so you can act faster and secure the best opportunities before others even know they exist.

Predictive Foreclosure Opportunities

AI doesn’t just look at current listings—it also predicts which properties are likely to go into foreclosure by scanning financial, legal, and historical data. This gives investors a head start on opportunities others won’t see until much later, often at discounted prices.

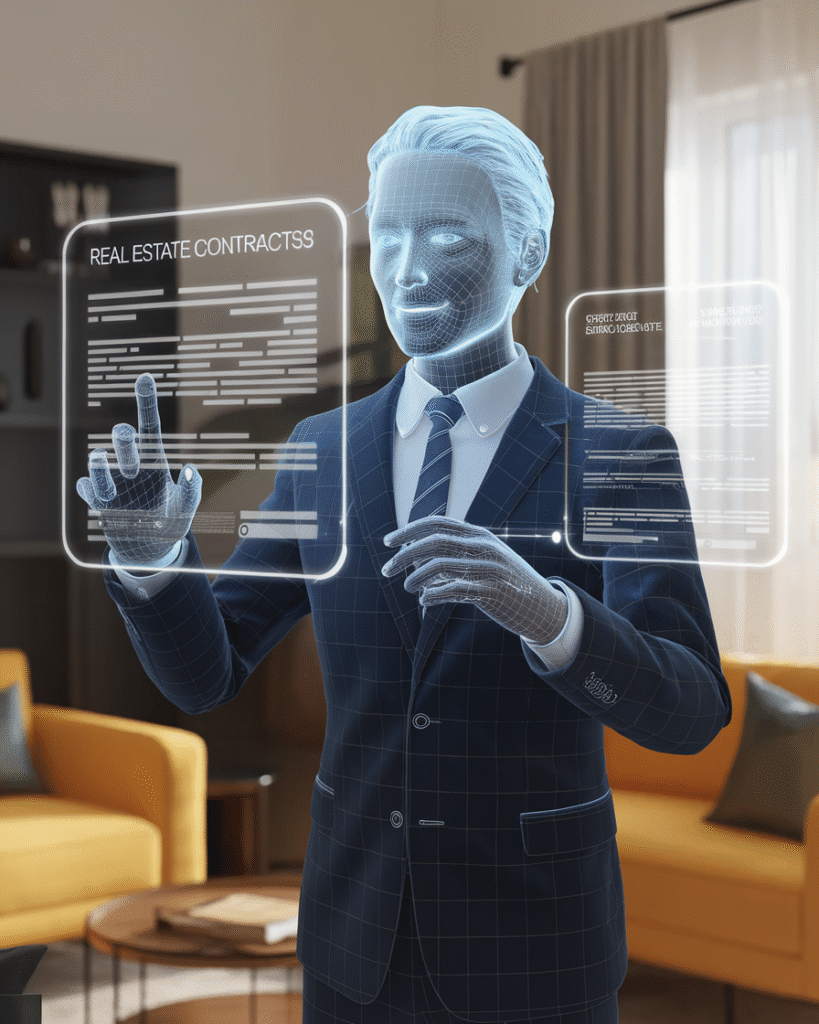

Virtual AI Assistants for Due Diligence

The paperwork and legal research involved in real estate can overwhelm even seasoned investors. Virtual AI assistants now summarize inspection reports, zoning laws, and contracts in minutes, saving time and reducing risk. This allows you to focus more on strategy and less on tedious reading.

Sustainability Scoring Systems

Eco-friendly properties are no longer just a niche—they’re becoming mainstream. AI evaluates energy efficiency, carbon footprint, and sustainable upgrades to provide a “green score” for properties. This appeals to eco-conscious buyers and tenants while often qualifying owners for government incentives.

Conclusion – Bringing How to Use AI to Find Profitable Real Estate Deals Into Your Life

AI isn’t just a tool—it’s a game-changer for modern investors. By combining data-driven analysis with human judgment, you can identify opportunities faster, minimize risks, and accelerate your financial growth. Start experimenting with AI platforms today, and you’ll be ahead of the curve in tomorrow’s real estate market.

FAQs About How to Use AI to Find Profitable Real Estate Deals

Q1: Can AI really predict profitable real estate deals?

Yes. AI uses historical data, rental trends, and economic patterns to predict profitable deals with high accuracy. While it can’t guarantee results, it reduces guesswork.

Q2: What’s the best AI tool for real estate beginners?

Mashvisor and DealMachine are beginner-friendly tools that simplify data analysis while offering powerful profitability insights.

Q3: How much does it cost to use AI for real estate investing?

Costs vary. Entry-level platforms start around $50/month, while advanced enterprise solutions can reach hundreds of dollars monthly.

Q4: Can AI replace real estate agents?

No. AI complements agents by handling data-heavy tasks. Human expertise is still crucial for negotiation and local market knowledge.

Q5: Is AI useful for small investors or only big firms?

AI benefits everyone. Even small investors can use it to find better deals, save time, and make smarter decisions.