Managing money in 2025 no longer needs to feel overwhelming. Thanks to AI, anyone can gain clarity over their finances, optimize savings, and even receive personalized financial coaching. This article explores the best AI tools for personal budgeting and saving money, walking you through benefits, step-by-step instructions, and expert strategies so you can finally take control of your financial future.

Why Best AI Tools for Personal Budgeting and Saving Money Matters in 2025

In 2025, personal finance is more complex than ever. Subscriptions, microtransactions, side hustles, and inflation all make it harder to track where your money goes. Traditional spreadsheets and manual tracking simply can’t keep up with modern spending habits.

AI-driven budgeting tools solve this by automatically categorizing expenses, forecasting financial trends, and offering personalized advice. They give you real-time insights so you can spend smarter, save more, and reduce financial stress. For individuals focused on personal growth, these tools provide the structure needed to build discipline and long-term wealth.

Top Benefits of Best AI Tools for Personal Budgeting and Saving Money

Automated Expense Tracking

AI tools can link directly to your bank accounts and credit cards, automatically classifying purchases into categories like groceries, dining, or entertainment. This saves hours of manual data entry and provides instant clarity.

Personalized Saving Insights

Unlike traditional apps, AI can study your habits and recommend tailored strategies. For example, it may suggest reducing weekend dining expenses or switching to a lower-cost subscription.

Predictive Financial Forecasting

AI budgeting tools can project your future balance, bills, and savings goals. If you want to buy a car in six months, the AI can calculate how much to save weekly.

Smart Alerts and Notifications

From reminding you about upcoming bills to notifying you when you’ve overspent in a category, AI ensures you stay on track without constantly checking your account.

Step-by-Step Guide to Best AI Tools for Personal Budgeting and Saving Money

- Choose the Right AI Tool – Research platforms like Cleo, YNAB with AI add-ons, or Mint AI upgrades. Look for features like bank syncing, goal-setting, and automation.

- Connect Your Accounts – Securely link your bank accounts, credit cards, and investment portfolios to get a full financial overview.

- Set Clear Goals – Whether you’re saving for an emergency fund or a vacation, input specific targets. AI will adjust recommendations to meet them.

- Review Automated Reports – Let the tool categorize expenses, then analyze your spending habits. Pay attention to areas with overspending.

- Activate Alerts and Automation – Enable bill reminders, savings transfers, and overspending alerts to automate financial discipline.

- Track Progress Weekly – Check dashboards weekly to ensure you’re meeting goals and adjusting when needed.

- Refine With AI Recommendations – Follow personalized insights for cutting costs, boosting savings, or rebalancing your budget.

Pro Strategies to Maximize Best AI Tools for Personal Budgeting and Saving Money

- Leverage Multiple Tools Together: Use one tool for budgeting and another for investment growth to cover all financial bases.

- Audit Subscriptions Quarterly: Let AI flag unused subscriptions, then cancel them to save instantly.

- Avoid Over-Automation: Automation is helpful, but always double-check settings to avoid accidental overdrafts.

- Pair AI With Human Advice: AI provides insights, but combining it with financial advisor input creates the strongest strategy.

7 Trending Applications in 2025 for Best AI Tools for Personal Budgeting and Saving Money

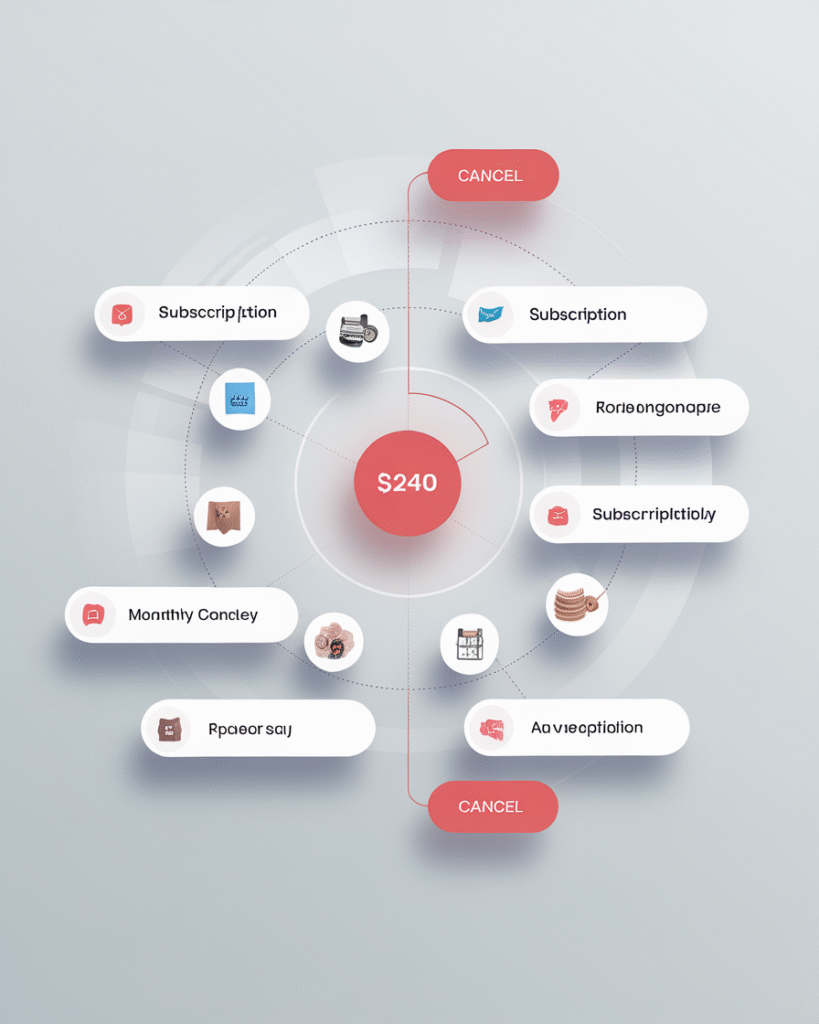

AI-Powered Subscription Management

Keeping track of subscriptions has become one of the biggest challenges for modern households. AI tools now automatically detect recurring charges across accounts, highlight duplicate services, and even suggest cancellations. This means you can cut out wasted spending without combing through statements line by line.

Smart Savings Bots

Instead of waiting to see what’s left at the end of the month, AI savings bots quietly move small amounts into your savings account. Many tools round up your purchases and stash the spare change, turning daily spending into long-term wealth without you noticing the difference.

Voice-Activated Budgeting Assistants

In 2025, budgeting doesn’t just live on your phone—it’s part of your home. By connecting with Alexa, Siri, or Google Assistant, you can ask real-time financial questions such as, “How much can I spend on groceries this week?” and get instant AI-powered answers.

Predictive Bill Payment Systems

Late fees are no longer a problem with predictive bill management. AI can forecast when bills are due, remind you ahead of time, and even pay them automatically. This keeps your credit score healthy while ensuring you never miss a payment again.

Gamified Savings Challenges

Budgeting can be fun when it feels like a game. AI-powered apps now turn saving into interactive challenges, complete with progress bars, trophies, and rewards. By transforming financial discipline into play, users stay motivated to hit their money milestones.

AI-Driven Investment Guidance

Budgeting is only the first step; building wealth comes next. AI tools now extend into investment guidance, suggesting safe opportunities tailored to your goals and risk level. With predictive analytics, they help you grow your money more confidently.

Financial Wellness Coaching

Sometimes money management requires more than numbers—it requires motivation. AI wellness coaches provide personalized nudges, encouragement, and practical advice on reducing debt and improving spending habits. It feels like having a supportive financial mentor available 24/7.

Conclusion – Bringing Best AI Tools for Personal Budgeting and Saving Money Into Your Life

AI is no longer just for big corporations—it’s a tool you can use daily to make smarter money decisions. By combining automation, personalized insights, and predictive forecasting, the best AI tools for personal budgeting and saving money give you the confidence and clarity to build lasting financial stability. Start small, follow AI’s recommendations, and watch how quickly your savings grow.

FAQs About Best AI Tools for Personal Budgeting and Saving Money

Q1: Are AI budgeting tools safe to use with my bank accounts?

Yes. Reputable AI budgeting apps use bank-level encryption and two-factor authentication to protect your data.

Q2: Can AI actually help me save more money?

Absolutely. By analyzing your habits, AI shows where to cut back and even automates savings so you build wealth without thinking about it.

Q3: Do AI budgeting tools work for people with irregular income?

Yes. AI adapts to your cash flow by learning patterns and helping you plan for variable income streams like freelancing or gig work.

Q4: How much do these tools cost?

Many AI budgeting apps are free or offer premium features starting around $5–10 per month. Often, the savings they help you achieve outweigh the cost.

Q5: Can AI tools replace financial advisors?

Not entirely. AI can provide excellent insights and automation, but pairing it with professional advice is the most effective strategy.